Stock market related ratios

Stock investing requires careful analysis of financial data to find out the company's true worth. This is generally done by examining the company's profit and loss account, balance sheet and cash flow statement. This can be time-consuming and cumbersome. An easier way to find out about a company's performance is to look at its financial ratios, most of which are freely available on the internet.

Though this is not a foolproof method, it is a good way to run a fast check on a company's health. It not only helps in knowing how the company has been performing but also makes it easy for investors to compare companies in the same industry and zero in on the best investment option," says DK Aggarwal, chairman and managing director, SMC Investments and Advisors.

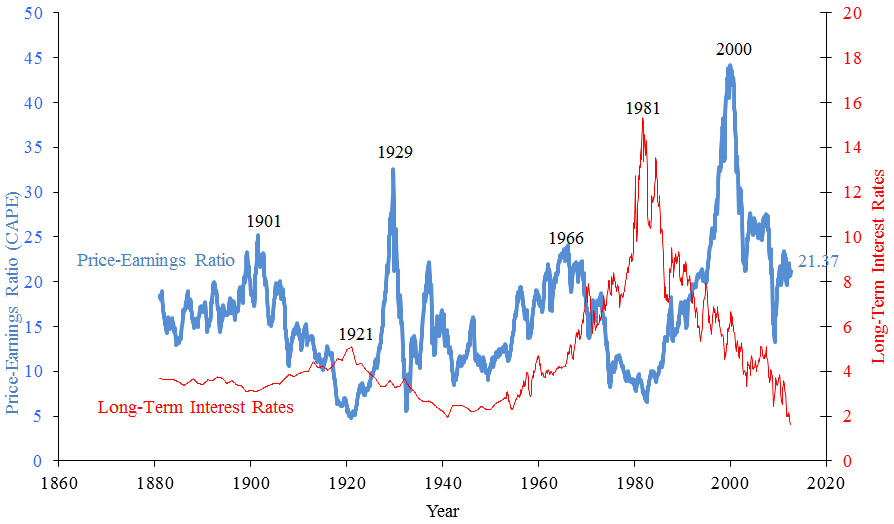

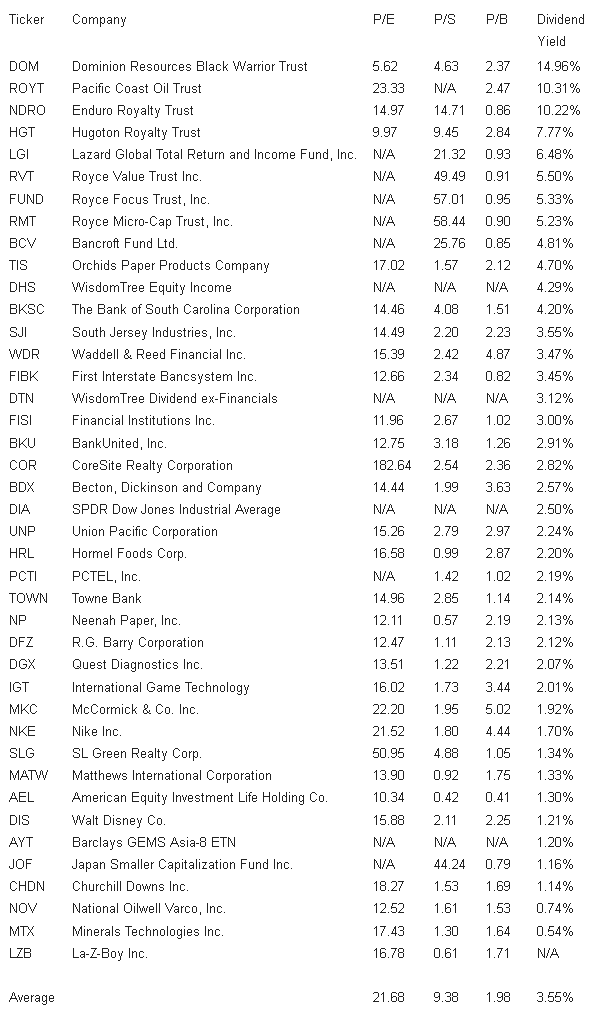

We bring you eleven financial ratios that one should look at before investing in a stock. It shows if the market is overvaluing or undervaluing the company.

Book value, in simple terms, is the amount that will remain if the company liquidates its assets and repays all its liabilities. It indicates a company's inherent value and is useful in valuing companies whose assets are mostly liquid, for instance, banks and financial institutions.

It not only helps in knowing how the company has been performing but also makes it easy for investors to compare companies in the same industry and zero in on the best investment option', says DK Aggarwal, Chairman and Managing Director at SMC Investments and Advisors. It shows how much a company is leveraged, that is, how much debt is involved in the business vis-a-vis promoters' capital equity.

Market Value Ratios and How They Are Used

A low figure is usually considered better. But it must not be seen in isolation. However, if it is not, shareholders will lose," says Aggarwal of SMC.

.jpg)

But it is not that simple. A high debt-to-equity ratio may indicate unusual leverage and, hence, higher risk of credit default, though it could also signal to the market that the company has invested in many high-NPV projects," says Vikas Gupta of Arthaveda Fund Management. NPV, or net present value, is the present value of future cash flow. OPERATING PROFIT MARGIN OPM The OPM shows operational efficiency and pricing power.

Algorithmic Trading Basics: Systems & Strategies | etygivusyx.web.fc2.com

It is calculated by dividing operating profit by net sales. Aggarwal of SMC says, "Higher OPM shows efficiency in procuring raw materials and converting them into finished products. It measures the proportion of revenue that is left after meeting variable costs such as raw materials and wages. The higher the margin, the better it is for investors.

While analysing a company, one must see whether its OPM has been rising over a period. Investors should also compare OPMs of other companies in the same industry. EV is market capitalisation plus debt minus cash.

It gives a much more accurate takeover valuation because it includes debt. EBITDA is earnings before interest, tax, depreciation and amortisation. This ratio is used to value companies that have taken a lot of debt. A lower ratio indicates that a company is undervalued.

Stock Profit Calculator | etygivusyx.web.fc2.com

It is important to note that the ratio is high for fast-growing industries and low for industries that are growing slowly," says Mukherjee of IIFL. The PEG ratio is used to know the relationship between the price of a stock, earnings per share EPS and the company's growth. This may give an impression that is overvalued. The result can be compared with that of peers with different growth rates. A PEG ratio of one signals that the stock is valued reasonably. A figure of less than one indicates that the stock may be undervalued.

The ultimate aim of any investment is returns. Return on equity, or ROE, measures the return that shareholders get from the business and overall earnings. It helps investors compare profitability of companies in the same industry.

A figure is always better. The ratio highlights the capability of the management. ROE is net income divided by shareholder equity. The main benefit comes when earnings are reinvested to generate a still higher ROE, which in turn produces a higher growth rate.

However, a rise in debt will also reflect in a higher ROE, which should be carefully noted," says Mukherjee of IIFL. It is earnings before interest and tax, or EBIT, divided by interest expense. It indicates how solvent a business is and gives an idea about the number of interest payments the business can service solely from operations. One can also use EBITDA in place of EBIT to compare companies in sectors whose depreciation and amortisation expenses differ a lot.

Or, one can use earnings before interest but after tax if one wants a more accurate idea about a company's solvency. This shows the liquidity position, that is, how equipped is the company in meeting its short-term obligations with short-term assets.

A higher figure signals that the company's day-to-day operations will not get affected by working capital issues. A current ratio of less than one is a matter of concern. The ratio can be calculated by dividing current assets with current liabilities. Current assets include inventories and receivables. Sometimes companies find it difficult to convert inventory into sales or receivables into cash.

This may hit its ability to meet obligations. In such a case, the investor may calculate the acid-test ratio, which is similar to the current ratio but with the exception that it does not include inventory and receivables. It shows how efficiently the management is using assets to generate revenue. The higher the ratio, the better it is, as it indicates that the company is generating more revenue per rupee spent on the asset.

Experts say the comparison should be made between companies in the same industry. This is because the ratio may vary from industry to industry.

Stock Market Basics - Financial RatiosIn sectors such as power and telecommunication , which are more asset-heavy, the asset turnover ratio is low, while in sectors such as retail, it is high as the asset base is small.

It is dividend per share divided by the share price. A higher figure signals that the company is doing well. But one must be wary of penny stocks that lack quality but have high dividend yields and companies benefiting from one-time gains or excess unused cash which they may use to declare special dividends. Similarly, a low dividend yield may not always imply a bad investment as companies particularly at nascent or growth stages may choose to reinvest all their earnings so that shareholders earn good returns in the long term.

While financial ratio analysis helps in assessing factors such as profitability, efficiency and risk, added factors such as macro-economic situation, management quality and industry outlook should also be studied in detail while investing in a stock.

Financial ratio investment in stocks asset turnover ratio return on equity dividend yield operating profit margin. Previous Story Track management's actions before investing in companies. Next Story Commodities to invest in this festive season.

Three years of Modi govt: PM wants you to tell the govt where it failed, here's how you can do it Sensex breaches 31, What should be the next move of investors? Micromax's Yu Yureka Black set to launch on June 1 Irrfan Khan's Hindi Medium earns Rs Reliance Jio Prime vs Airtel, Vodafone, Idea 4G offers Reliance Jio plans to bring 5G internet to your smartphones Maruti Suzuki opens online booking for Baleno RS India Inc to get 9. Micromax's Yu Yureka Black set to launch on June 1 OnePlus 5 brings OnePlus 3T production to an end, but sales will continue till stocks last Xiaomi's pre-order for Redmi Note 4, 4A to begin today Xiaomi launches Mi Max 2 in China OnePlus 5 to feature Snapdragon inside, says CEO Peter Lau More.

News You Can Use.

List of Important Financial Ratios for Stock Analysis - etygivusyx.web.fc2.com

Dhoni's every single run cost Rs 4. Here's why Dhola-Sadiya bridge will be good for Indian economy What is WannaCry Ransomware and how it is different from other cyber attacks How to make your workstation fun and exciting More. ECONOMY CORPORATE MARKETS MONEY INDUSTRY TECH OPINION PHOTOS VIDEOS MAGAZINE PROPERTY.