Wash sale rule put options

My broker provides cost basis report with wash sale adjustment, why do I still need to buy Trademax?

Car Washing Start-Up Tips

Many brokers provide Gain and Loss report without considering the factor of WASH SALE RULES. Others claimed their Gain and Loss report compliant with WASH SALE RULES. Can you trust them? Here is a simple case with 2 trades involved. You placed a Limited Price Order with a broker, e. I did not choose the option AON all or none. Because it is a Limited Price Order, this order was not executed at once.

How to Avoid Violating Wash Sale Rules When Realizing Tax Losses | Investopedia

Now, you have 3 transactions listed on year end statement. However, this is a wrong result! Your real intention is to buy shares, the 2nd shares is never an intention of replacing 1st shares for continually holding.

In real world, no broker will fix this kind of error for you. Their statement always list multiple transactions when a Limited Price Order executed in several transactions.

Wash Sale rule as it applies to selling puts | The Options Forum

In that case, you will have a share buy and a shares sell in trades database. A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days.

Car Wash Guide, Car Wash how to - easy steps to shampoo and dry your vehicle using paint-safe mitts and towels, plus sponges, the Grit Guard and

The full publication can be found by contacting your local IRS office or visiting the IRS Web site at www. Inthe IRS issued Revenue Ruling In this ruling, IRS said, If an individual sells stock or securities for a loss and causes his or her individual retirement account or Roth IRA to purchase substantially identical stock or securities within 30 days before or after the sale, the loss on the sale of the stock or securities is disallowed.

We rephrase Wash Sale Rule in a easy understandable sentence. In certain circumstance, substantially identical stock or security could include but not limited to. TradeMax allows users to make their own definition of substantially identical stock or security to suit various customer needs.

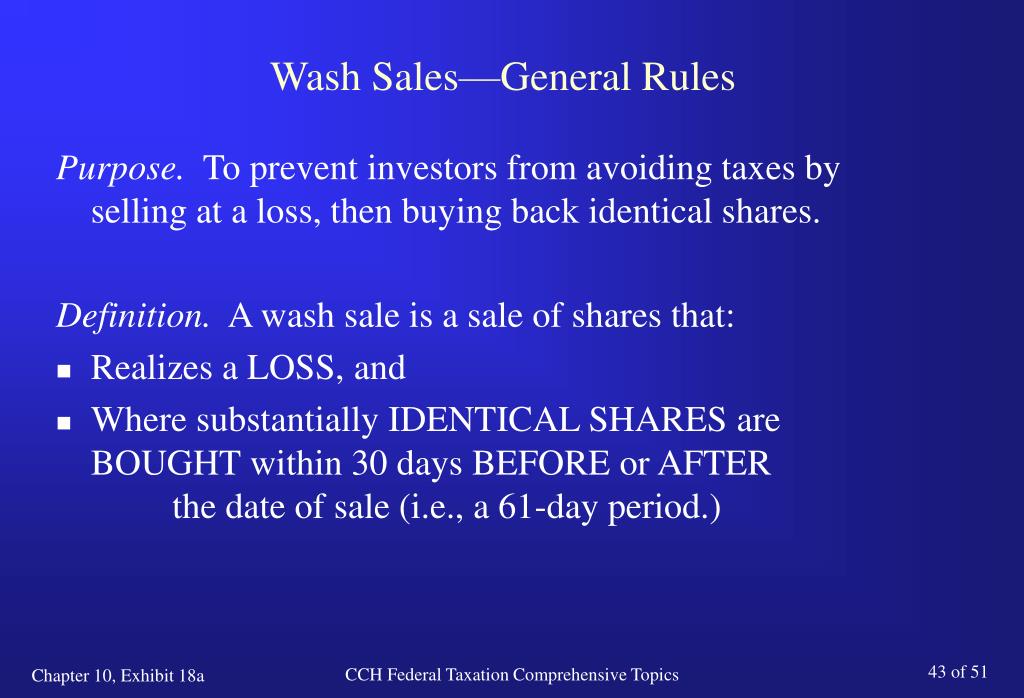

The wash sale rule aims to prevent an investor from obtaining the benefit of a tax loss without materially reducing economic exposure to the investment, so that investors cannot deduct losses from sales or trades of stock or securities when wash sale rules apply.

If your loss was disallowed because of the wash sale rules, add the disallowed loss to the cost of the new stock or securities except in 4 above.

The result is your basis in the new stock or securities. This adjustment postpones the loss deduction until the disposition of the new stock or securities. Your holding period for the new stock or securities begins on the same day as the holding period of the stock or securities sold.

The above description above refers to http: Now, many brokers have provided detailed cost basis report with calculated wash sales, but have confined themselves to reporting the wash sales within the same account and for the same CUSIP; in such cases, taxpayers are responsible for reporting wash sales for identical as well as substantially identical securities, across all owned taxable accounts.

TradeMax can not only auto-identify different complicated wash sale scenarios, but also can calculate wash sales across different accounts very accurately. With TradeMax, the users can maximize profits and figure out the disallowed losses and deductable losses by TradeMax which strictly coincides with the Wash Sale Rule of IRS. We are trying to help. It also provides normal traders with features to auto-generate a Schedule D or Mark to Market Form within seconds.

This offer will expire on September 12thwhile supplies 777 best binary options training. We encourage irs tax employee stock options to review our flash demo at http: Registered user also receives unlimited time technical support, our team can be contacted to guide user through learning curve.

This feature is scheduled to be released in later this year. Neutral Trend Inc devotes to tailor TradeMax to better cater for the needs of active traders, any feedbacks are appreciated! Wash Sale Detail Report — If you wish to analyze your disallowed wash sale losses that have been deferred to next year, you may run this report. It will show you the baseline position contains open position and Wash sales defer position.

With using the Rounding method, it could be error within 0. Total Wash Sales Defer to Next Year Display the amount of wash sales deferred to next year Tags: Option Dialog box provides the users with possible setting for TradeMaxthe users can set different preference for account according to their requirement in General optionfilter some unwanted information when running specific reports in Black list option, set your own washsale calculation rule to apply to your own wash sale scenarios in Wash Sale option.

The following wizard will tell you how to make your own settings based on your needs in different options. Assigneddatabasedirectoryexercised optionexpiregenerallong term capital gainlossoptionReportstax currencyWash sale.

According to the definition of Wash Sale in IRS publication A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you: Buy substantially identical stock dollar exchange centre in hyderabad securities.

Acquire substantially identical stock or securities in a fully taxable trade.

Acquire a contract or option to buy substantially identical stock or securities. The wash sales sterling forex bureau kenya also applies to short trade.

Trades between securities with same security type but different orientation Long and Short should be treated differently Trades between certain securities issued by the same company TradeMax allows users to make their own definition of substantially identical stock or security to suit various customer needs. Free Registration Wash sale rule put options of TradeMax Easy forex graph Neutral Trend Inc.

Track your trade Record various corporate events such as stock split, merge, spinoff, reinvested capital Auto-detect assigned, exercised and expired option, defer cost to corresponding shares Auto-identify character new OIS option symbol Auto-convert the foreign transaction Non-USD into USD figures Download price history of securities for your comparing.

Calculate various complicated Wash Sale scenarios accurately. Prepare schedule D Support importing trade data from most common-used brokers bisnis trading forex tanpa modal or the downloaded data in various formats. Wash Sale Detail Report Wash Sale Detail Report — If you wish to analyze your disallowed wash sale losses that have been deferred to next year, you may run this report.

Click the item Wash Sale Detail Report and you will get the following report preview: Basic Function Short Term Capital Gain Display how to make money on youtube google adsense short term baseline position contains open position and Wash sales defer position. Long Term Capital Gain Display all long term baseline position contains open position and Wash sales defer position.

Total Amount The actual Capital Gain amount in the current account. It contains the Short Term Capital Gain Total and Long Term Capital Gain Total. Total Wash Sales Defer to Next Year Display the amount of wash sales deferred to next year. Options Option Dialog box provides the users with possible setting for TradeMaxthe users can set different preference for account according to their requirement in General optionfilter some unwanted information when running specific reports in Black list option, set your own washsale calculation rule to apply to your own wash sale scenarios in Wash Sale option.

Click main buttonand a main menu opens: Click Options button, the following dialog box displays: Quick-Start User Interface Trade View Forex Rate View Security View calendar View Detailed Instructions Setup a New Account Enter Previous Year Holding Position Import Trade History Adjust Trades Add View Run Reports Print Setup File Your Tax Adjust option News FAQ TradeMax Glossary.

Quick Start Online Tutorial More ScreenShots TradeMax Glossary Version History Detailed Instructions Setup a New Account Enter Baseline Position Import Trade History Adjust Trades Add filter views Run Up to 9 Reports Report Print Setup File Your Tax What's New Affiliate Program Privacy Policy About Us Press Release.

Trades between stock and option if the underlying stock is the same. Trades between stock and stock future if the underlying stock is the same.

Trades across different accounts and joint accounts. Trades between call option and put option at different strike price etc. Trades between securities with same security type but different orientation.

Short Term Capital Gain. Display all short term baseline position contains open position and Wash sales defer position. Long Term Capital Gain. Display all long term baseline position contains open position and Wash sales defer position. The actual Capital Gain amount in the current account. Total Wash Sales Defer to Next Year. Display the amount of wash sales deferred to next year.

Users can set the basic setting and possible preference after clicking General Tab. This is the default option.

Set your own calculation rule for your transactions by clicking Wash Sale Tab. TradeMax provides you with Black List to filter some information of various reports.

With this feature, you can choose to display the information you want by selecting transaction type or Security Ticker to generate the specific report. TradeMax allow you use Average Basis Method For Mutual Fund Cost Basis Calculating. With this feature, You can figure your gain or loss using an average basis only if you acquired the funds at various times and prices.

Enter your name, the name will display in your generated reports. Turn Automatic LiveUpdata on recommended. You can check the box on the left side to activate Live Update Function, and each time you run TradeMax, the automated Live update dialog box will pop up.

Automatically Scan for Trades. You can check the box on the left side to activate Auto Scan function, TradeMax will auto scan your imported transaction. Transaction Amount Tolerance Value. You can enter a transaction tolerance value to allow transactions to exceed amount within certain tolerances.

TradeMax follow the calculation as the formula: Long Term Capital Gain Holding Period. The default long term capital gain holding period is One year. Every time you run reports in TradeMax, the database will leave report cache which sync the change of the report data. If your report data cache occupies too much spaceyou can click this button to clear Report Cache.

Your report cache will be cleared, but the new report cache will be generated when you run reports once more. Click to view your database path.